South America, which has always kept a low profile in the global economic map, has suddenly gathered the attention of a host of companies in the power battery industry chain for the very simple reason that there are source minerals for lithium batteries.

In July this year, Ganfeng Lithium, through its subsidiary Ganfeng International, launched a tender offer for Canada's Millennium Lithium, with an agreed purchase price of no more than C$353 million (approximately RMB 1.837 billion) at the time. Unexpectedly, CATL swooped in and made an offer for C$376.8 million (approximately RMB1.944 billion) in September. Not only did CATL offer approximately 7% more than Ganfeng Lithium, it also agreed to pay Ganfeng Lithium a US$10 million termination fee.

Just when the market was generally expecting Millennium Lithium to be in CATL' pocket, Lithium Americas suddenly kicked in with a US$400 million offer and agreed to pay CATL a US$20 million (approximately RMB130 million) termination fee for its cooperation. Millennium Lithium left CATL 10 working days to consider the offer, CATL did not choose to adjust the offer upwards and Americas Lithium intercepted the deal successfully.

It is worth noting that Ganfeng Lithium is the majority shareholder holding 12.5% of Americas Lithium's shares and has a director on board. As a result, despite repeated denials by Ganfeng Lithium, suspicions of behind-the-scenes "instructions" continue to abound.

The auction drama, which has been reversed several times, is a microcosm of the growing battle for lithium resources. Millennium Lithium became the focus of the battle precisely because it owns two salt-lake resources in Argentina. CATL, which was awarded 130 million yuan in liquidated damages from the battle, has not given up its global search for lithium. Within just a week of the matter falling apart, CATL appeared at the negotiating table with the Argentinean state-owned enterprise to talk about lithium development and said bluntly, "The company has been supplying batteries to the world's most important car companies for 11 years and is now focusing more on resources such as lithium."

In the days when lithium was used only in the general consumer market, the supply of raw materials for lithium-ion batteries was never an issue. But with the wave of electric vehicles coming, lithium resources, an important material for batteries, are becoming increasingly important.

The power battery is the "heart" of the new energy vehicle, and its cost ratio accounts for nearly 40% of the total cost of the vehicle, and to a certain extent holds the lifeblood of the development of new energy vehicles. The current two mainstream power battery technology, whether lithium iron phosphate or ternary lithium batteries, cathode materials are the highest cost of materials, because it directly determines the safety performance of the battery, accounting for about 40% of the cost of lithium battery core materials, and lithium is precisely the core raw material of cathode materials.

Last year's electric car outbreak initially, CATL the most anxious raw materials when the ternary lithium battery required nickel, cobalt and other rare metals. As for lithium resources, after experiencing the new energy vehicle trough in 2019 and encountering the outbreak of the new crown epidemic, downstream demand has decreased significantly, and the price of lithium salt has gone all the way down, from 160,000/ton in 2018 to 40-50,000 yuan/ton in 2020.

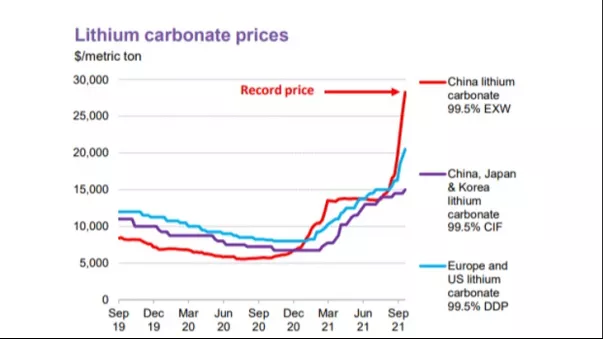

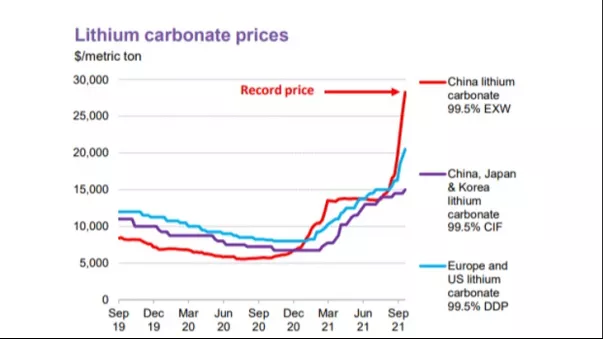

(Lithium carbonate price trend (2019.9-2021.9)

In 2021, the price of lithium resources has surged and even gotten out of control. Year-to-date, lithium carbonate prices have risen by more than 230%. Compared with the end of last year, the cumulative price increase of battery-grade lithium carbonate and lithium hydroxide has reached 260%-310%. Compared with the last cycle of lithium carbonate price increases, this wave has broken through the previous round of 180,000 yuan / ton of the highest price.

Global electric vehicle deliveries have been hitting new highs since this year, so some analysis has attributed the rise in lithium raw materials to a mismatch between supply and demand. But in fact, from the demand side, the demand for lithium salt for power batteries belongs to a small even rise, the demand in September last year was 11,800 tons, the average basic single month demand this year is basically 15,000 tons up and down. Global shipments of lithium hydroxide + lithium carbonate have likewise remained stable, at around 40,000 tons in September last year and reaching around 50,000 to 55,000 tons per month this year. The soaring prices are clearly not matched by the relatively flat supply and demand curve.

In fact, the supply and demand problem is not only manifested in the present, but strong demand in the distant future reinforces the value of the resource end. Older car companies in Europe, the US, Japan and South Korea have set clear timetables for fuel vehicle sales discontinuation this year. As a result, market hoarding sentiment is high as power cell manufacturers have announced a doubling of production expansion. The increased influence of the seller's market has also exacerbated the imbalance and upward movement of offers.

Institutional analysis of upstream materials is far from over, and a third lithium price increase has been brewed and initiated. According to estimates, the lithium supply growth rate in 2022 is between 33%-35%, but the downstream cathode, battery universal scheduling planning doubled, the supply increment can be fully covered by demand, so the lithium supply and demand shortage pattern will continue, battery-grade lithium carbonate prices or reach 250,000 yuan / ton, lithium salt prices in 2022 or continue upward.

Even if the raw materials rise alarmingly, but the battery companies do not dare to easily increase prices. This is because the competition in the field of power batteries has been very fierce, the price increase of battery companies is likely to lead to a large loss of their own orders. Moreover, in the industry chain has a strong voice in the vehicle manufacturers have a price reduction target every year, more will not promise to raise prices.

In the third quarter of 2021, in the case of a significant increase in installed capacity, the profit level of many power battery companies fell rather than rose. In stark contrast, the upstream material suppliers ushered in a big performance explosion.

As the lithium iron phosphate battery route is widely accepted, the nickel and cobalt resource anxiety that has plagued CATL for a long time has come to an end, and more than 72% of lithium resources need to rely on imports and become one of the industry's biggest pain points.

In fact, lithium resources are not a rare metal. From the perspective of lithium, manganese, nickel and other core battery materials mining potential, the global lithium resources economic recoverable reserves of 21 million tons, if the ternary 811 battery material system, can produce batteries 200 billion kWh. according to the average of a car 100 kWh, can make 2 billion electric cars.

However, the natural "distribution" of lithium resources is seriously uneven for the current mining wars to lay the groundwork. Seventy-five per cent of the world's lithium resources are concentrated in the "three lakes and seven mines" of South America and Australia. The lithium hydroxide needed for ternary batteries is mainly mined from Australian mines; lithium carbonate needed for lithium iron phosphate batteries is mainly mined from South America's salt lakes. With the installed capacity of lithium iron phosphate overtaking that of lithium ternary batteries, the salt lakes of South America have naturally become the object of competition among battery companies.

Stretching the timeline, this similar to the land auction era of the bid may be just the beginning of another larger competition. The major European car manufacturing nations, led by Germany, are also beginning to focus on the battery industry and do not want to be overly dependent on foreign parts suppliers. Not long ago, the world's largest producer of manganese, nickel, mineral sands and high-performance alloys, Eramet (Eramet Group, France), also restarted construction of a lithium extraction plant in the Argentine salt-lake.

In August this year, the Biden administration announced its new energy vehicle plan, making it clear that it would take steps to promote US leadership in clean cars and trucks. The US Departments of Energy, Defense, Commerce and State have also jointly released the National Lithium Battery Blueprint (2021-2030), with the goal of building US domestic capacity to process raw materials for lithium batteries and to reduce dependence on sensitive materials.

In light of current trends, it is true that whoever can occupy the upper reaches of the industry chain will win the future.

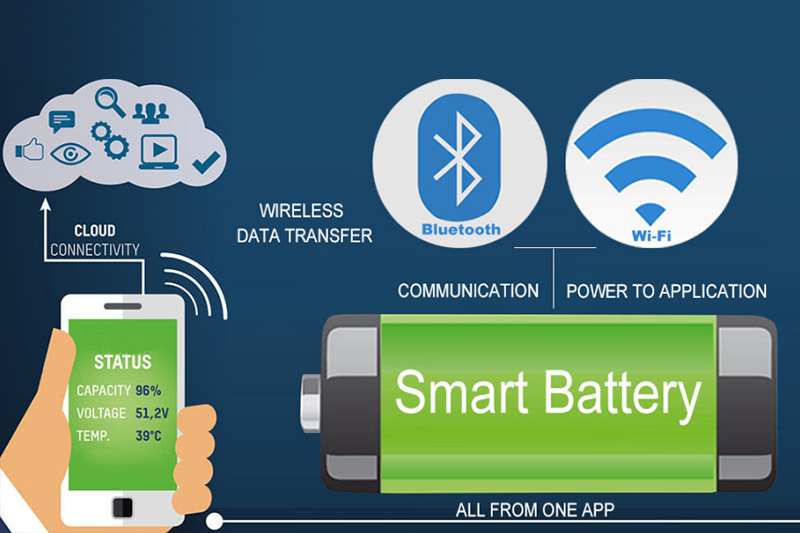

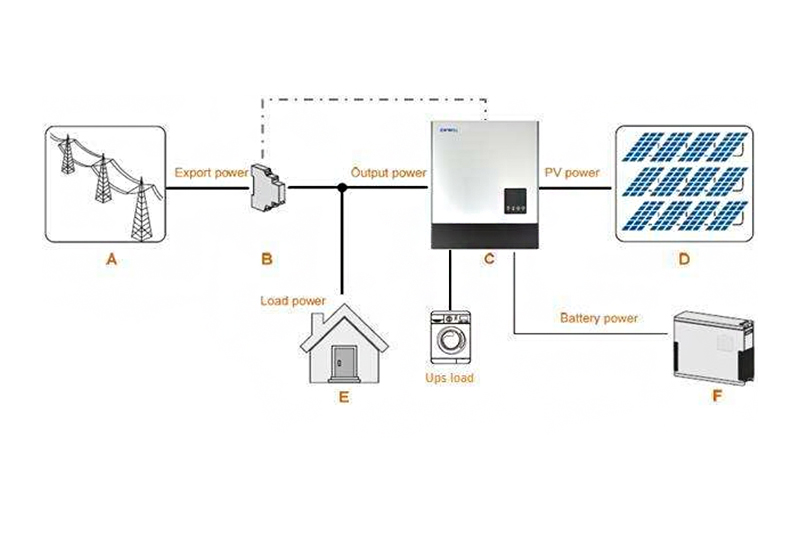

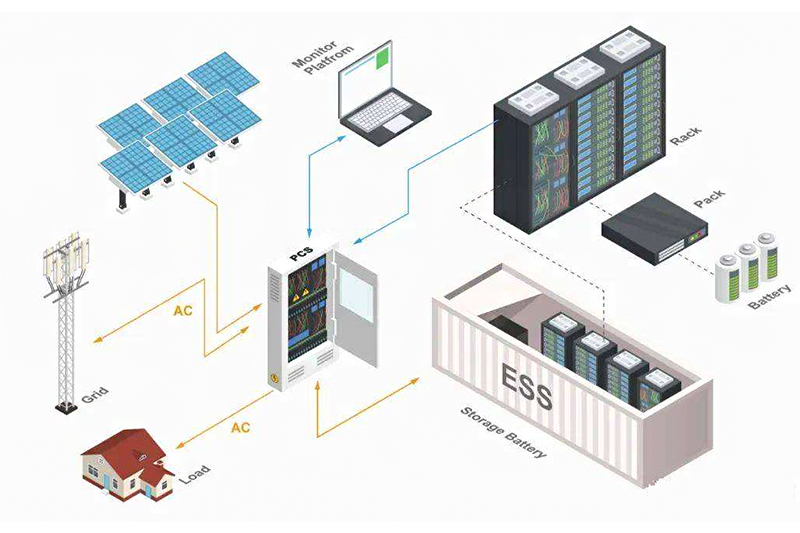

Lithium-ion batteries (LIBs) have become the main energy storage solution in modern life. Among them, lithium iron phosphate batteries are perfect replacements for lead-acid batteries, and are even more preferred for grid-connected peaking, off-grid energy storage, photovoltaic energy storage, UPS, data centers and other industries.