Analysis Report (2): Cost and Value of Hybrid Energy Storage Projects in

the United States

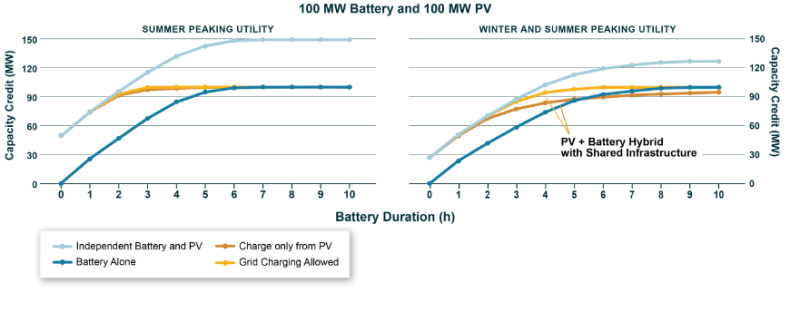

5. Capacity Value

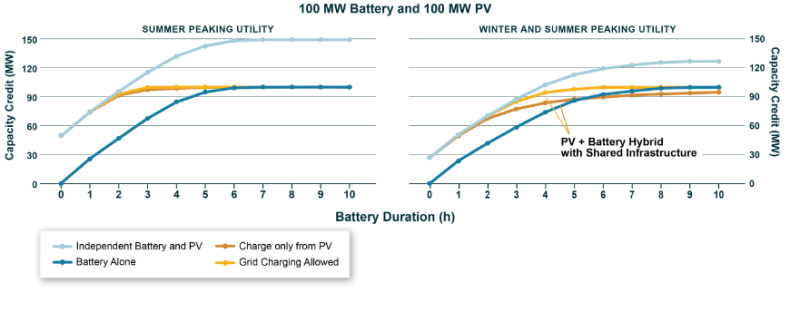

(1) The capacity contribution of a hybrid deployment project is less than

the sum of its parts

The capacity contribution of hybrid projects varies by region and depends

on configuration and operational constraints. Sharing hybrid project base

projects can reduce costs, but may reduce capacity value.

(2) Capacity certification is critical for hybrid deployment projects

Electricity systems require sufficient generation capacity to meet peak

electricity demand, often well above average. Variable renewable energy can help

meet this need. However, their contribution gradually decreases with increasing

penetration due to changing demand patterns, which poses a barrier to

decarbonization of electricity. Pairing renewable energy generation facilities

with energy storage systems can alleviate this challenge and provide a path to

more reliable and clean energy.

(3) New methods are needed to easily assess the relative capacity

contribution of hybrid deployment projects

Methods for determining individual resource capacity credits, such as

effective carrying capacity, rely on data-intensive and complex probabilistic

models. Using these models, it is difficult to explore changes in capacity

contribution across various configurations, operational constraints, regions,

and scenarios.

(4) The capacity contribution of a hybrid deployment project is not the sum

of the parts

Hybrid deployment recommendations typically share underlying projects or

introduce new operational constraints among various energy components. Shared

infrastructure projects (including inverters or interconnection to the grid) may

lead to competition for limited capacity, reducing the contribution of

individual element capacity in mixed deployment projects. This is most evident

when renewable energy facilities generate electricity at times that coincide

with periods of high reliability risk.

6. Ancillary Services

(1) Ancillary services market is a valuable but short-lived option for

hybrid deployment projects

Analysis shows that, in at least some parts of the US, hybrid projects can

unlock significant value from the ancillary services (AS) market. But the

ancillary services market is likely to become saturated with most battery

storage projects currently in the interconnection queue.

(2) Ancillary service terms can provide additional market opportunities for

hybrid deployment projects

As wind and solar power make up a larger share of the power generation

system, there is growing interest in enabling these resources to provide

additional reliability services to the grid by participating in the ancillary

services (AS) market. This opportunity can provide hybrid deployment project

owners with an additional revenue stream to offset the decline in energy and

capacity value due to increased penetration of solar and wind power.

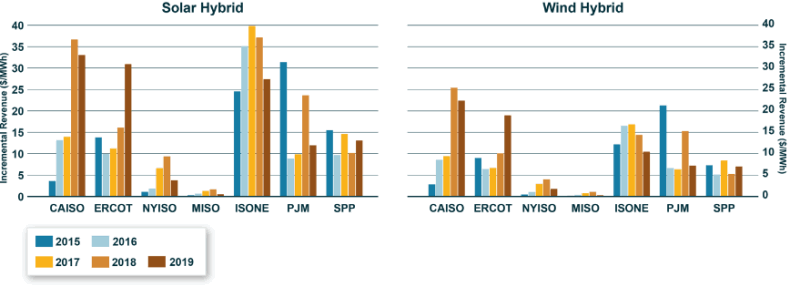

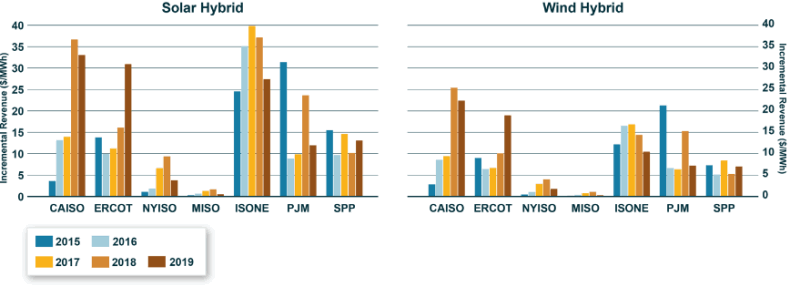

(3) Ancillary Services Market Significantly Increased Revenues for Hybrid

Deployment Projects

According to the study, owners of hybrid deployment projects participating

in the ancillary services market and the energy market will receive additional

income relative to the energy market alone. Whereas the study focused on the

regulatory reserve markets, which typically have the highest prices among

ancillary service products. The study found that participating in the regulated

market can generate additional revenue from 1/MWh to $33/MWh (increase of 1% to

69%) for hybrid deployment projects (as shown in the figure below).

(4) ISO/RTO can differentiate ancillary service offerings to prioritize

hybrid deployments

The distinction between separate up- and down-regulation products could

allow wind, solar and energy storage projects to more efficiently provide

regulation reserve services. Independent system operators (ISOs) and regional

transmission organizations (RTOs) should first prioritize the participation of

hybrid projects in the ancillary services market, and then consider how

independently deployed wind and solar facilities can participate.

(5) The ancillary service market is relatively weak

Supply growth can lead to market saturation and lower prices for ancillary

services, even in regions with higher incremental value for standalone and

hybrid projects. In 2017, Independent System Operators (ISOs) and Regional

Transmission Organizations (RTOs) procured an average of about 60-800MW of

conditioning reserve services. By contrast, independent system operators (ISOs)

and regional transmission organizations (RTOs) have more than 289GW of

standalone and hybrid energy storage systems in their interconnection queues by

the end of 2021, while regulating reserve requirements are only 4.8GW.

7. Market participation

(1) Hybrid deployment projects can participate in the electricity market

more flexibly

The multiple configurations of hybrid projects increase the opportunity and

complexity of tendering and dispatching in the electricity market. Renewable

energy developers will be able to assess the risks and rewards of running a

hybrid deployment project as a single unit or as multiple parts with different

functions. Grid operators may find new ways to leverage hybrid deployment

projects to maintain reliability.

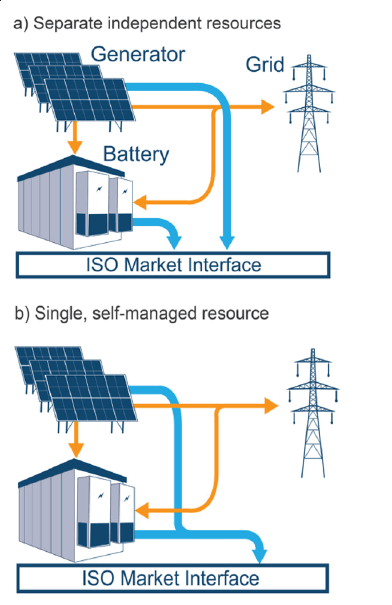

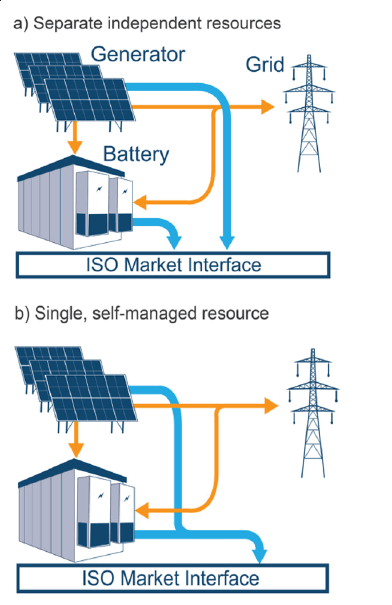

(2) Consider two advanced market participation models

Hybrid deployments can interact with wholesale electricity markets as a

single, fully integrated resource or as separate but co-located resources. As an

integrated resource, hybrid project operators must forecast wind or solar power

generation and manage their accompanying battery storage systems when developing

market bids. Managed as separate resources, wholesale market operators will

implement methods to manage the dispatch of battery storage systems and the

variability of wind or solar generation, taking into account any coupling

constraints.

(3) Developer preferences vary

Developers and market operators will evaluate the cost and revenue impact

of each model. Currently, separate but co-located models are the most popular

choice in California. However, if the hybrid deployment project is designed to

follow scheduling signals other than wholesale market prices (such as peak load

reduction, incentive plan payments, or elastic benefits), hybrid deployment

project owners may favor the high degree of autonomy offered by the fully

integrated model. Regulators should strive to maintain flexibility in

participation in order to stimulate innovation.

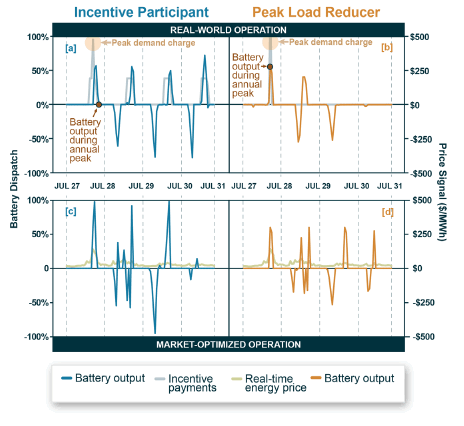

8. Operation

(1) The power system value of hybrid deployment project systems depends on

how they operate

Apart from technical features and location, the operational strategy of

solar + energy storage projects is a key driver of their market value.

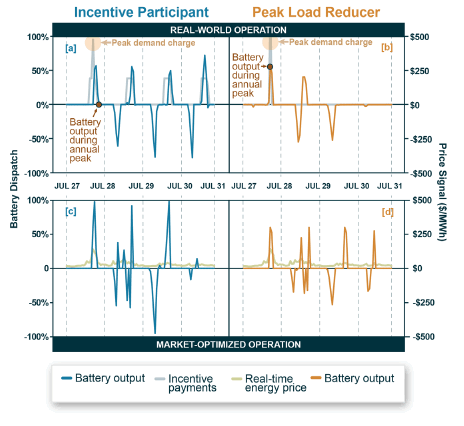

(2) Not all large-scale solar+storage projects pay attention to wholesale

price signals

Behavioral models for solar-plus-storage projects typically assume that

project operators optimize battery storage usage and ultimately generate more

revenue in the wholesale market. But after examining empirical dispatch data

from hybrid plants across the U.S., it was found that only a handful of

solar-plus-storage projects operating in 2020 focused primarily on price signals

in the wholesale market. In contrast, participants in special energy storage

incentive programs (such as SMART) focus on the timing of incentive payments

(see Figure a), load-serving entities attempt to reduce their exposure to

capacity and transmission demand charges (Figure b), and energy consumers

prioritise Consider resiliency and minimization of utility bills. These

alternative business models can generate higher revenues for solar-plus-storage

project operators, but do not optimize energy storage scheduling from a grid

perspective and can sometimes hinder grid revenue.

(3) Contracts limit the flexibility of solar+storage projects, thereby

hindering optimal scheduling

A sampling of power purchase agreements (PPAs) for solar-plus-storage

projects found that a number of constraints are often imposed on the operation

of battery storage systems, such as limits on the number of charges per year (or

per day), state-of-charge requirements, and depth-of-discharge limits, even who

controls the scheduling (buyer vs seller or in some cases shared). While most of

these limitations stem from battery warranty and management degradation, they

can still cause energy storage system scheduling to deviate from optimal

conditions based on wholesale electricity price signals.

(4) The use of user-side energy storage systems to maximize

self-consumption of solar power generation facilities has little market

value

Net billing has become the primary successor to net metering, providing

reduced compensation for solar power output to the grid. This arrangement

encourages solar power facility customers to deploy battery energy storage

systems in order to shift solar power generation to a time when they can use it

for their own use. For recent historical market prices, research has shown that

operating energy storage in this way does not actually add any value to bulk

power systems. In contrast, the potential annual value of an energy storage

system, if operated to optimize its market value, is $16/kWh to $33/kWh.

9. Distributed hybrid deployment project

(1) The growth of solar + energy storage projects on customer sites

provides new opportunities

Among all battery energy storage systems cumulatively deployed in the

United States by 2020, 30% are user-side energy storage systems (calculated by

installed capacity), most of which are deployed in conjunction with solar power

generation facilities.

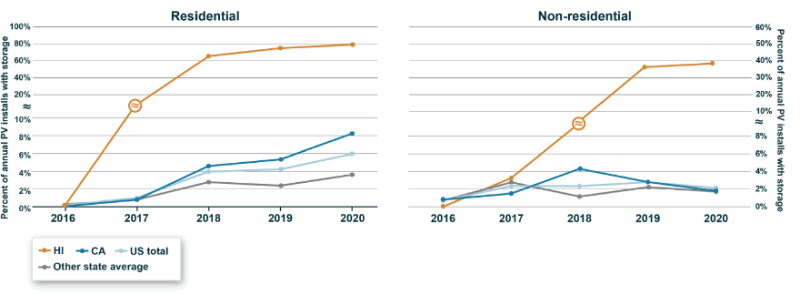

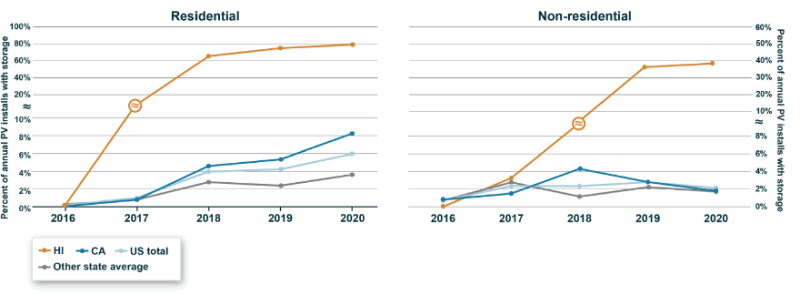

(2) The proportion of residential solar power generation facilities

supporting the deployment of energy storage systems has steadily increased, but

the growth rate of the non-residential market is not large

The proportion of residential solar installations with energy storage has

been growing steadily, but still represents a small portion of the market,

accounting for 6% of US residential solar installations installed in 2020. In

the non-residential market, only 2% of solar power generation systems installed

in 2020 will be equipped with energy storage systems, as these customers are

more likely to deploy battery energy storage systems independently.

(3) The scale of residential solar + energy storage projects is getting

bigger and bigger

Most residential solar-plus-storage projects typically deploy a 5kWh

battery storage system with a duration of about 2 hours. However, residential

solar-plus-storage projects are getting bigger as customers seek greater backup

power. System configurations in the non-residential market are more diverse,

with an average size of about 100kW/200kWh for residential solar+storage

installed in 2020.

(4) Residential solar installers are more widely accepting energy storage

systems than non-residential solar installers

About half of residential solar installers deploy solar + battery systems,

compared to only 17% of non-residential solar installers.

(5) Prices of residential solar + energy storage projects are on the

rise

Deploying an energy storage system to complement the user-side solar system

will increase the total deployment price by about $1,000/kWh, which ranges from

$700 to $1,300/kWh. For a typical residential solar-plus-storage project, this

adds about 30% to the cost of a stand-alone residential solar facility.

10. future development research

(1) How will it develop in the future?

While hybrid deployment projects offer an opportunity to alleviate the

intermittent challenges of renewable energy generation facilities, their

relative novelty means that research is needed to facilitate integration and

foster innovation.

(2) More research is needed to understand the potential of hybrid

deployment projects

Evaluating the strengths and limitations of hybrid deployment projects is

challenging due to the complexity of combining energy storage or conversion

technologies and multiple renewable energy sources. Project developers, system

operators, planners and regulators will benefit from better data, methodologies

and tools to estimate the cost, value and system impact of hybrid deployment

projects.

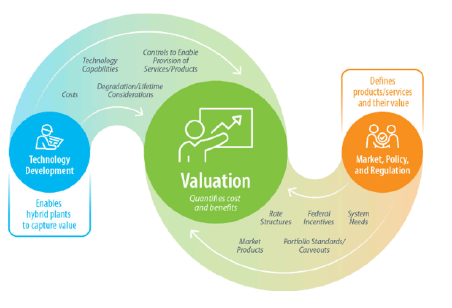

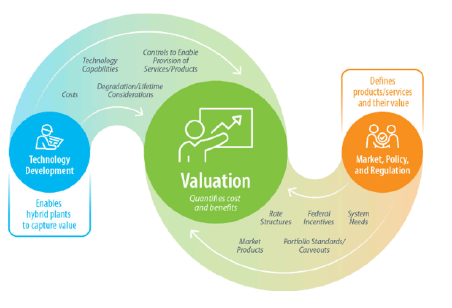

(3) The U.S. Department of Energy (DOE) has identified three high-priority

research topics for hybrid deployment projects

A recent DOE report titled "Hybrid Energy Systems: Opportunities for

Coordinated Research" identified areas of near-term opportunity for research and

development of hybrid deployment projects (below): Technology developers can

develop and demonstrate new hardware and software, to achieve co-optimized

resources for hybrid deployment projects. Market, policy and regulatory research

can develop frameworks to ensure efficient investment and operation of hybrid

projects. Both areas of research support refined valuation methods for

quantifying the costs and benefits of hybrid projects in the power system.

(Overview of priority areas for research on hybrid deployments and their

interdependencies)

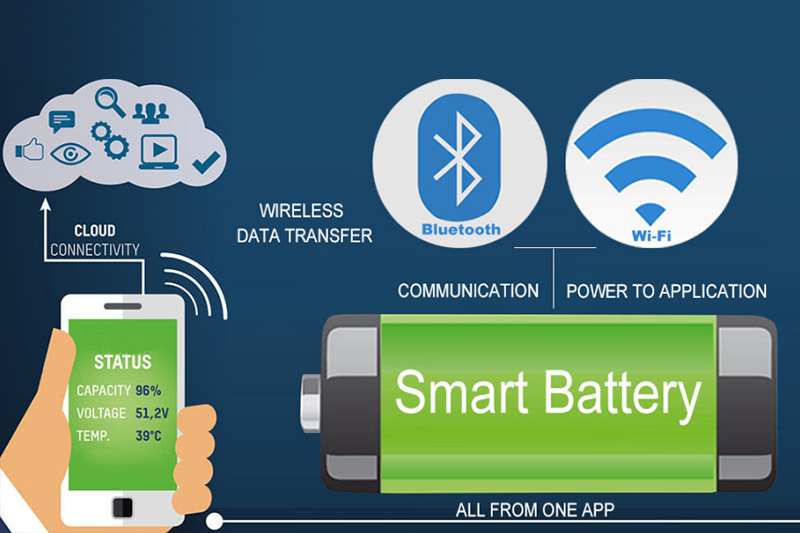

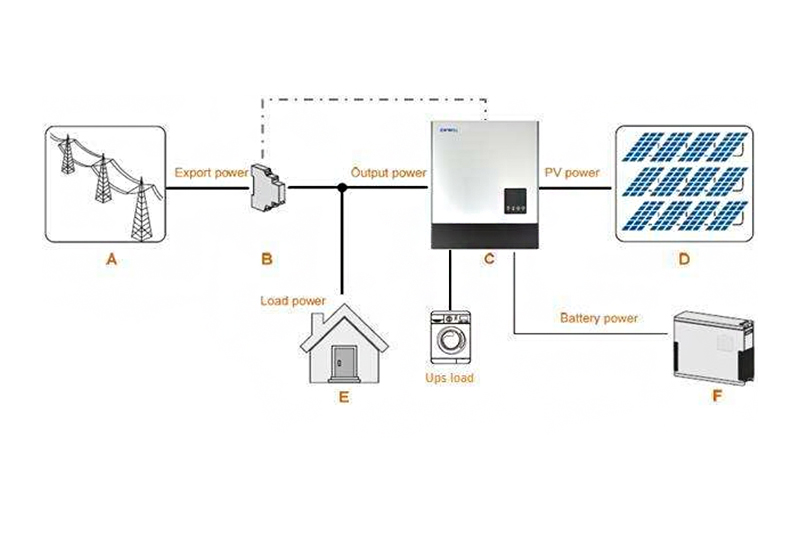

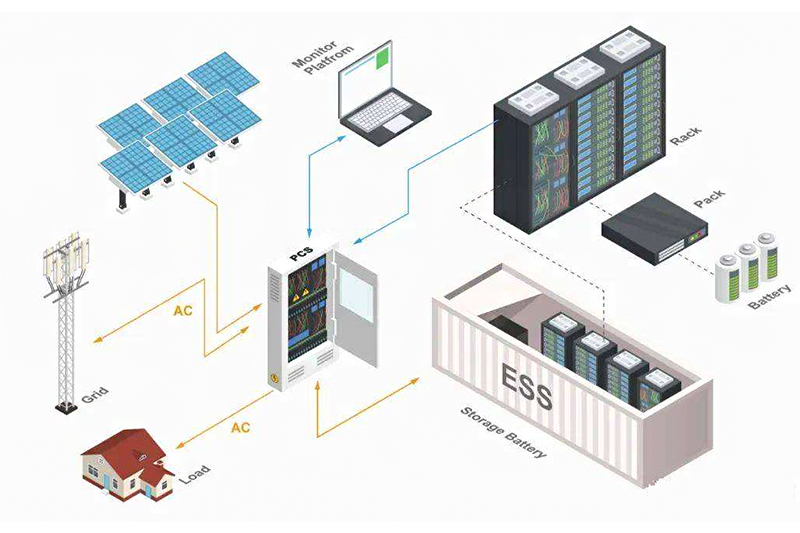

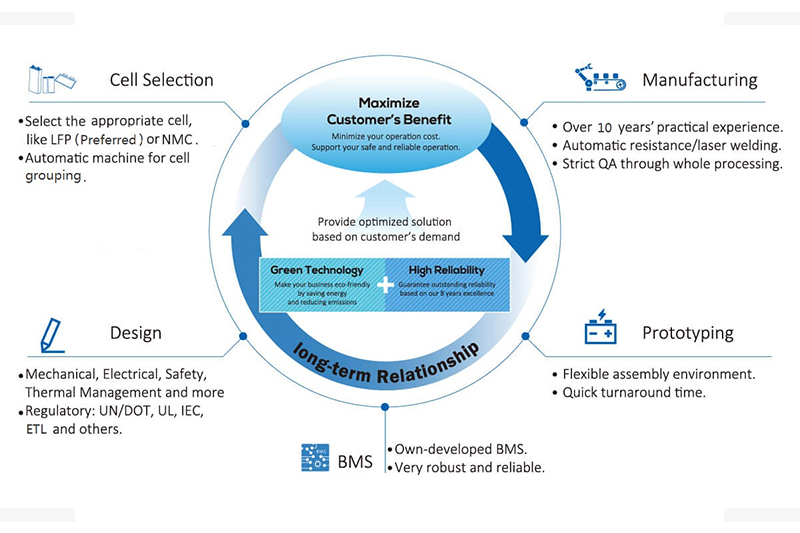

The United States is a very potential energy storage market, which is

recognized by almost everyone. SES Power, as a professional lithium battery

energy storage manufacturer, almost all of our energy storage products use

well-known brand batteries, such as EVE, CATL, BYD, products cover 12V to 560V,

capacity from 1KWh to 1MWh, covering lead Acid replacement, industrial support,

UPS, RV, solar energy storage, home energy storage, etc. These products are

almost all standardized and modularized, integrating RS485, CAN and other

communication protocols, supporting remote monitoring and operation, and adding

AI intelligent analysis and cloud storage to the new generation of systems,

which can ensure system compatibility, high speed, and reliability.